Weekly Analysis 8/25/2024

With last week wrapped up, it appears its all but decided that the rate cuts are coming! Here is my take on the price action last week and what we could have to look forward to this week and beyond. Outlook for my previous writeup was that anything over 19,610 was bullish and that case seemed to play out. We pushed up out of the gate and ran into that overhead, round number of 20,000. Participants decided that was a great place to start the selling into JPOW’s Jackson Hole speech. Thursday saw a clean sell from that 20,025 level straight back to the 19,610 point of interest. 610 held and with JPOW saying, it is now time to cut, price gave a nice spike up and then summer, Friday trading took hold and we ended up mainly flat. One other very important thing to consider was the surprise NFP revised number that came in at NEGATIVE 818K. That is quite the revision and the timing of this was something we should keep noted. Now that last week is in the books lets look ahead at what will move us this week.

Purple box is still that contract gap that I find to be a solid reference point. 19,610 still holding and is a great spot to see buyers stepping in.

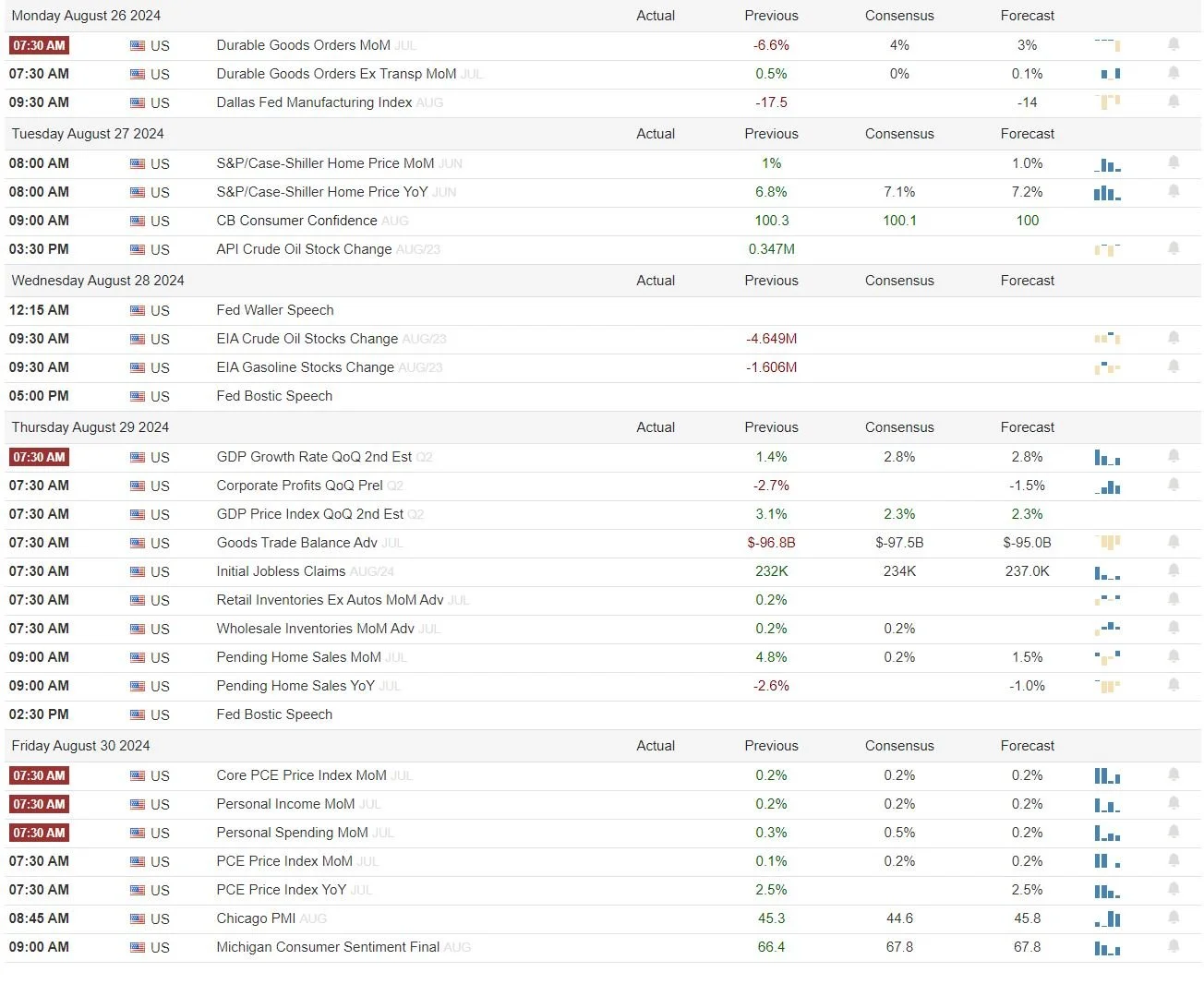

Looking ahead we always start with our important data releases for the week:

Plenty of data spread throughout the week, however nothing that I think will really push the needle one way or the other. As I mentioned it appears it has been decided that cut is coming at the September meeting and the data has been supporting the Fed's stance on when they would. Overall just note the times and either be flat, or manage your open positions accordingly. It is still Summer Trading and slower days, data and algos you could get some whipsaw action at these times.

Earnings for the week:

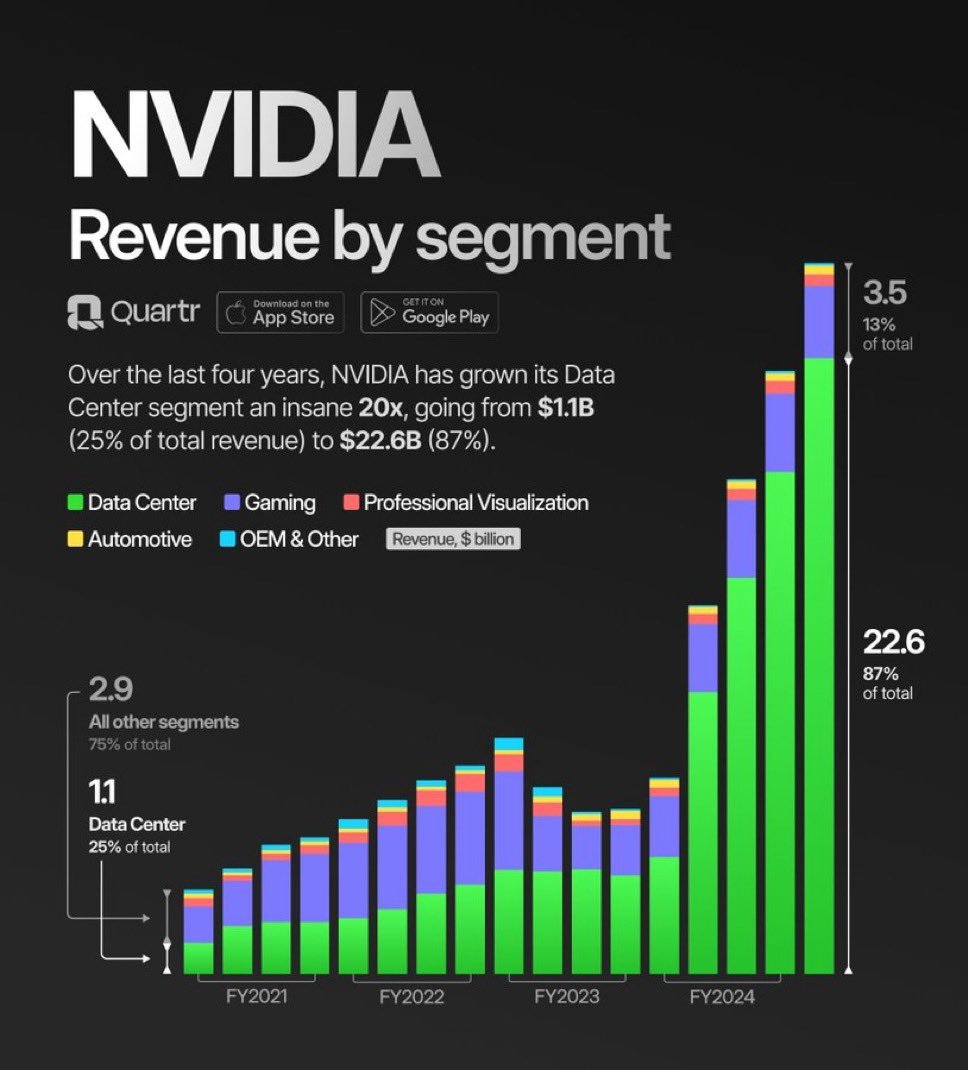

ALL EYES ON THE NUMBER 1 NAME OUT RIGHT NOW. $NVDA REPORTS ON WEDNESDAY AFTER CLOSE!!!!!!! Not much else to say here. This is the name that has been driving markets this year. As a futures trader this is the main focal point for the week and could lead to some crazy PnL swings. There is little rhyme or reason with earnings plays so unless you have a very specific strategy let this thing dance and note the levels for Thursday's session.

Headlines moving Markets:

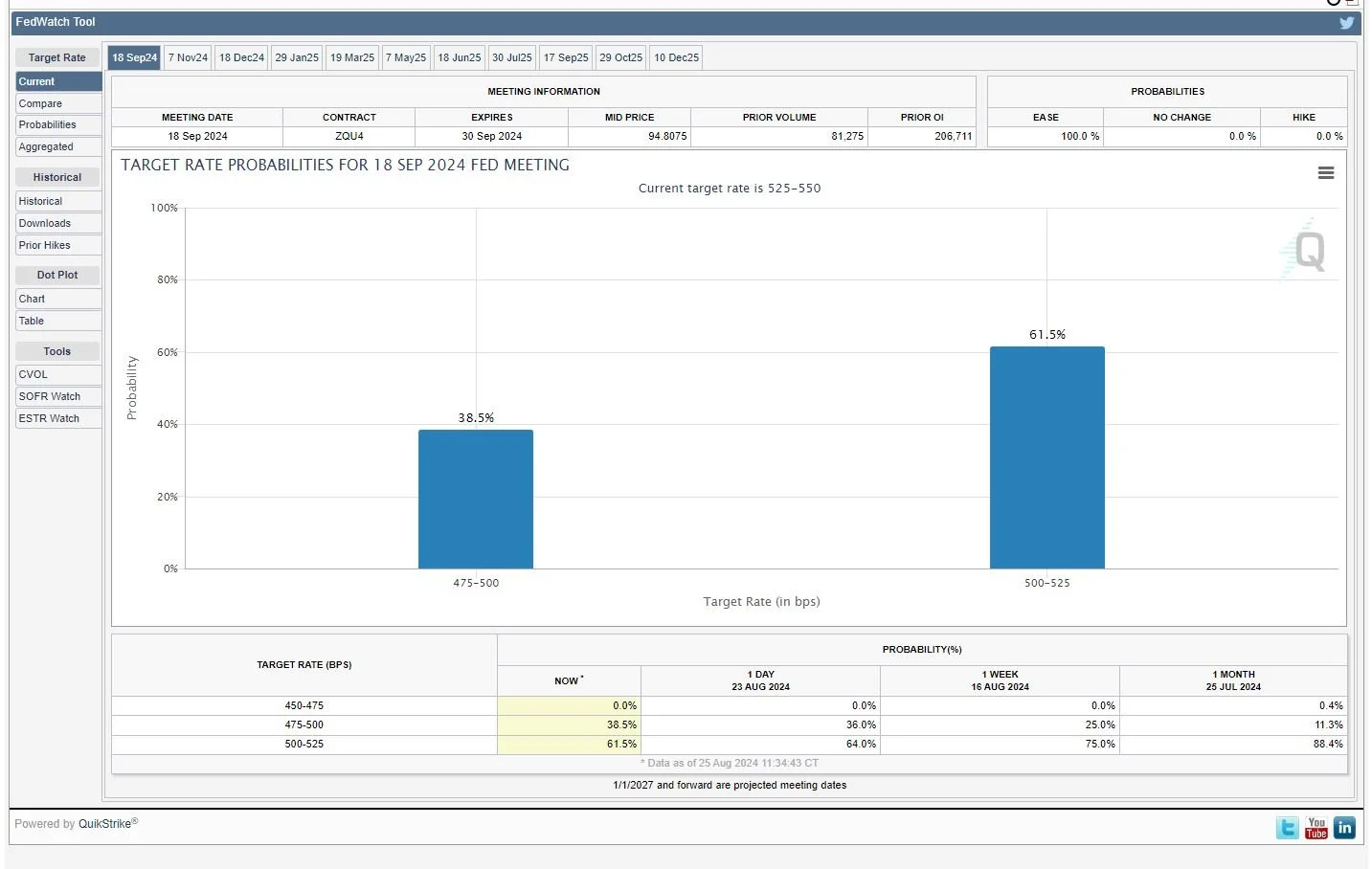

If you cannot tell this is 100% priced in as a cut. This is a great resource for anyone who wants to see what types of rate decisions are being factored in. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

HERE ARE MY NQ LEVELS TO WATCH FOR THE WEEK:

Overall we are back to the areas I mentioned from last week so all the levels overhead are in play as long as we hold 19,760. Down below we have that 19,610 level and should that give up the low I see playing is the 19,398 level. Still believe until that September 18 rate decision the grind is to the high side and likely to all time highs. How it gets there is another story. Trading the week will be interesting until Wednesday for NVDA earnings. I would think that pushing up to near that 20,000 level will be an area participants would get positioned to play either the long to highs or a great area to be short from, should NVDA sell off on this report. It is still summer trading, be careful on lower volume days and understand what data will be out each morning prior to your session. Let the market tell you what direction to trade and execute accordingly.

Streaming Schedule for the Week Ahead:

30 DAY BOOTCAMP IS HERE.

THERE ARE LAST MINUTE SEATS STILL AVAILABLE!

HIT MY LINK AND USE CODE POLICINGPIPS FOR 10% OFF

Monday TEACHING THE BOOTCAMP

Tuesday TEACHING THE BOOTCAMP

Wednesday 0830-1100 CST

Thursday 0830-1100 CST

Friday: 0830-1100 CST

Stream can be found here TRADECASTER

and on YOUTUBE

As always if you have any questions or comments about this writeup, my trading, the coffee or just want to say hi, please fill out the form below and leave some comments! Everything I share here is for your benefit, if you would like me to add any information or analyze some other charts please let me know as I will only add something if I am trading it otherwise.