Weekly Market Outlook 3.9.25

It is that time of the week again. Markets are open, the week is beginning, and a fresh opportunity is ahead of us. Last week we mentioned that it was a headline risk market and we saw that volatility continue through the week. Downside targets were the play for the week with the tariff war dominating the headlines and the 20,000 level was where we saw the bottom get flushed on Friday. The gap up on Sunday was filled, trapped some longs early Monday and then we got the sellers to take control the rest of the week. NFP came and went and as I mentioned really did not do much in the grand scheme of the direction moving forward. As we move into this week and the rest of the month, the same facts remain, headline risk and increased volatility is the current story and do not expect that to change in the near term.

NQ 4h chart shows the directional nature of last week. You can see the zone at the bottom as well as that blue line could be acting as support. (Blue line is a long term channel low)

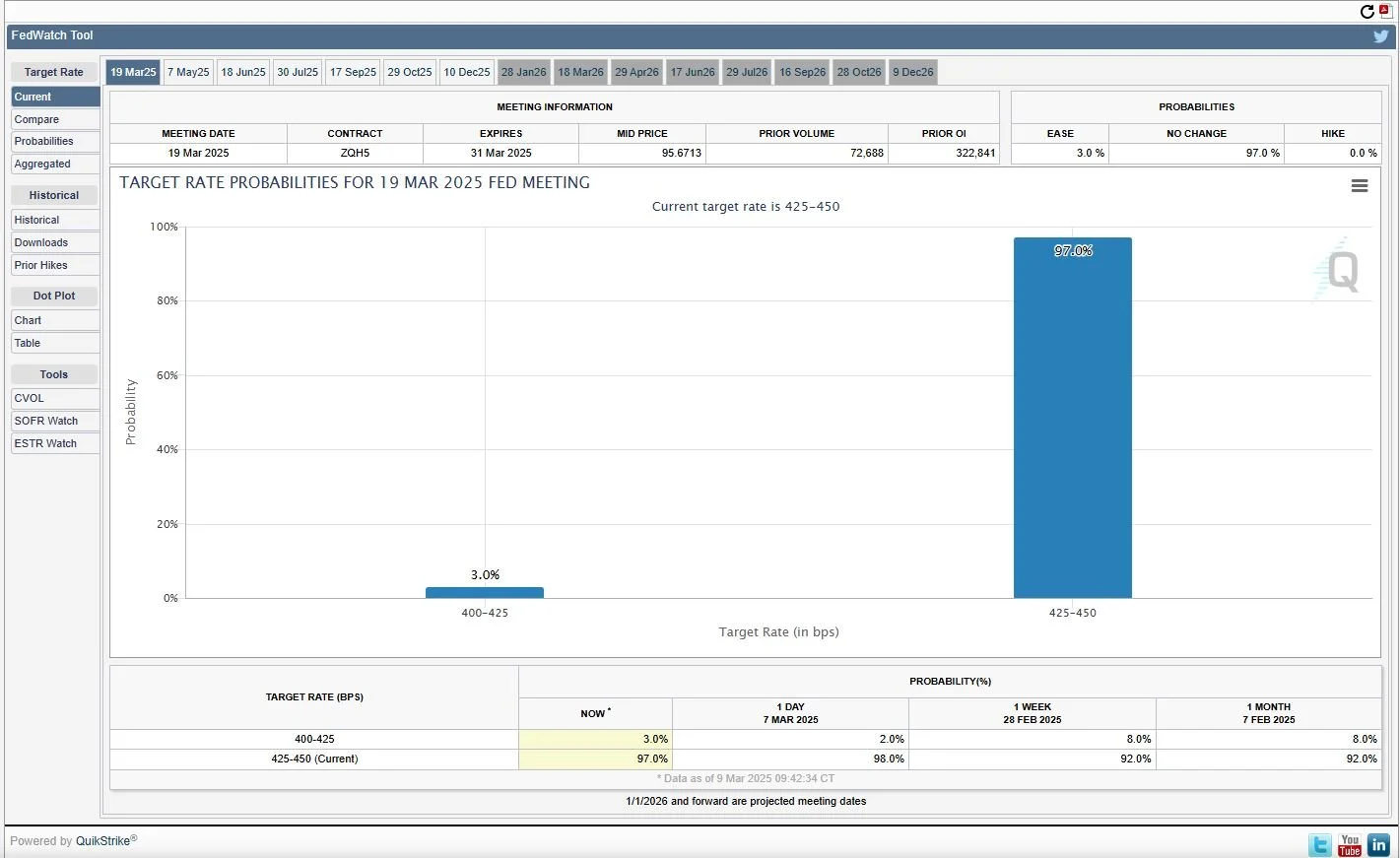

As mentioned there is little to no thought on a Fed rate cut and the current outlook from the Fedwatch is 97% hold rates as is.

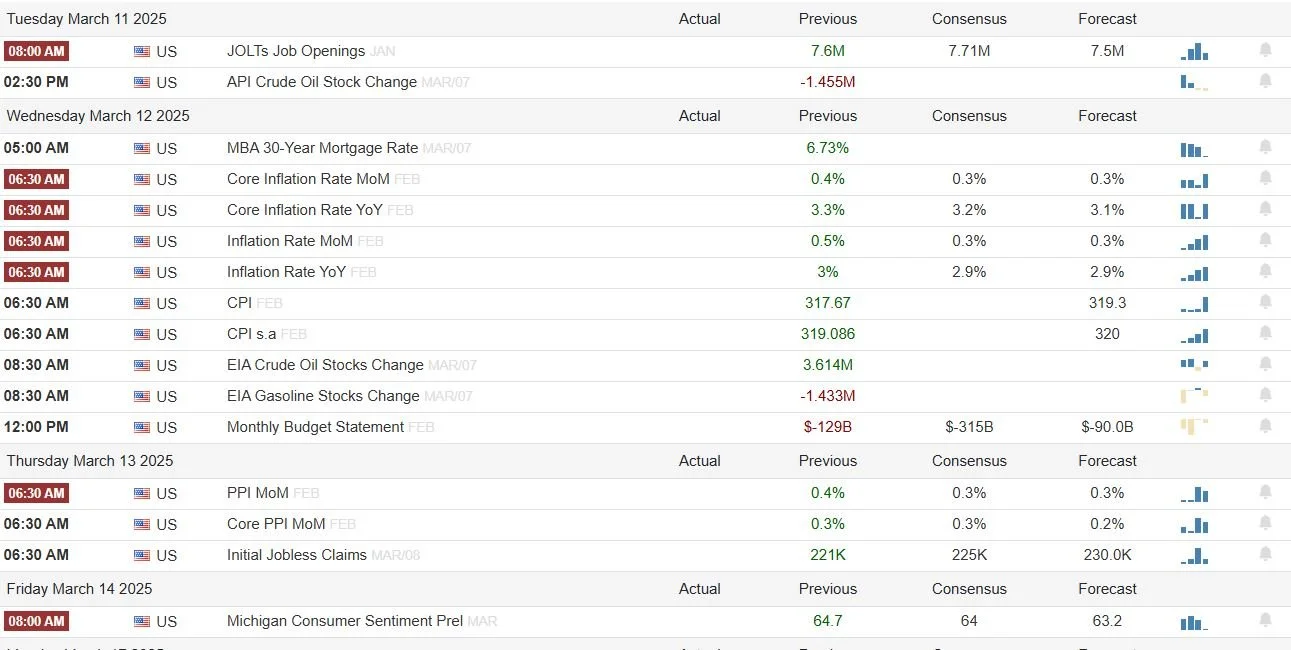

Data releases for this coming week:

Like I said, the data points are less of a concern lately for major movement, however you need to be aware of them and keep tabs on how the market does react to the release. CPI and PPI are always something to watch and if we continue to see some decreased inflation then maybe we do start to price in a cut from the Fed at some point this year.

The most anticipated earnings reports coming for this week:

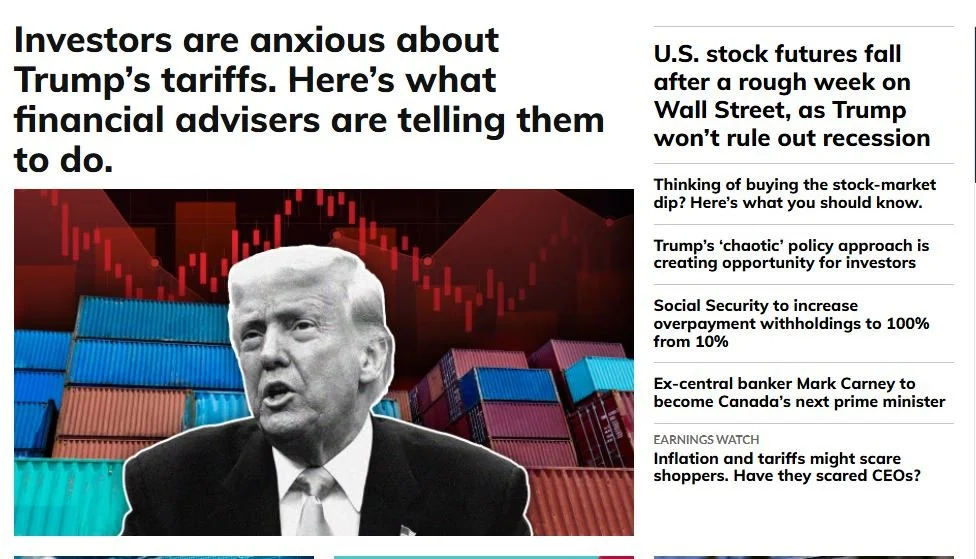

THE WEEKENDS HEADLINES:

Not just one major headline, more like a broad stroke of fear. When you click the homepage of MarketWatch this is all you see, same on Bloomberg and I am sure elsewhere. What does this tell you? Watch how the market acts when everyone is telling you to be scared. Did the market correct last week? Absolutely. Did it Crash? No. Do not let money grab headlines drive your decision making process in the markets.

Seeing a new face in Canada could spell a new deal in the US/CAD trade “war”. Expect there to be a renewed conversation between the two countries and see where this takes us as this moves forward. The new guy here says he wants respect, I am sure the conversation with Trump will grow into a partnership.

Overall, global tensions are still high as wars continue to wage overseas. At any moment in time a poorly executed strike, an escalation, or a peace deal could lead our markets into even further volatility. My recommendation is to keep a squawk of some type open while you trade, or some news feed at least. I use https://www.financialjuice.com/home its Free and its up to the minute usually with most releases.

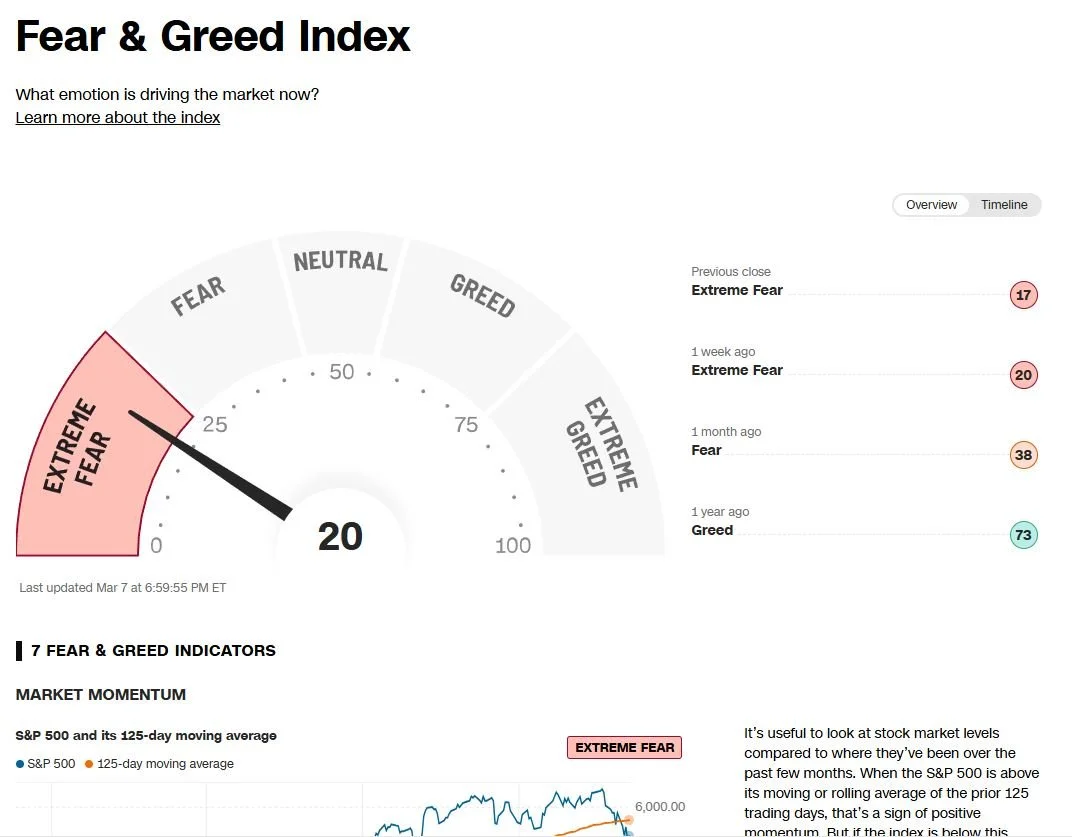

Fear and Greed Index:

Looking ahead to my levels for this week on the NQ:

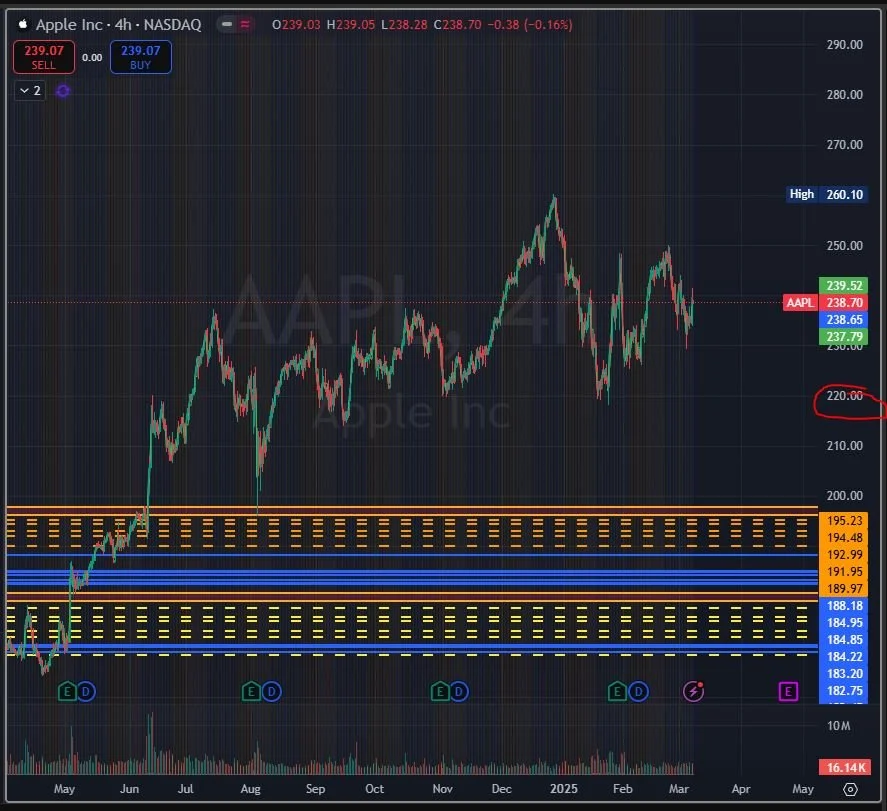

We are opening here again with a gap, this time to the downside. The trend all week was lower and all of our downside targets were hit with the ultimate 20,000 level coming in on Friday. We got the flush down through that blue support line down to 19,765.50 which immediately recovered and gave a nice buying pressure into the close. This level is important because it is the bottom end of a long term up trend channel that began at the 2023 lows. With the fear coming in, us at this key support, I would expect some bulls to try and defend early this week. Into CPI and PPI we could hold and even trap lower before recovering later in the week. Should we bounce, close this gap and hold above it, I anticipate the downside levels to be our targets back to the upside and, depending how early we bounce in the week, could recover all of last weeks selloff over the previous Gap. If we do get some headlines or something that really drives this market even lower, we could be in for some pain. The next level is the bottom of the zone at 19,600ish then below that 19,130 and into 18,707 and even 18,000. These lows would spell danger and I do not think we could be at that point here yet. Also see the charts of NVDA, MSFT and AAPL below. These names have had some selling into some key structure points, but long term are still very strong companies. The NQ is weighted so heavily in the mag 7 that the relative strength will likely keep things propped up. Unless however these names start to melt off as well, then yes, we may keep rolling.

30 min levels for this coming week on the NQ.

NQ weekly chart showing that bottom blue line from the lows in 2023.

NVDA has that 100 level that should hold us up and MSFT looking at 380 to hold.

AAPL 220 will also be that line in the sand number.

We partnered with The Futures Desk!

TFD is new to the Futures Funding space and has a whole new outlook on how things are done.

Customize your eval. From drawdown to targets and even how much it costs, you are in control!

USE CODE POLICINGPIPS FOR BEST RATES ALWAYS!!!!

Once past your eval, there is no sim, it is straight to LIVE BROKERAGES!

Top of the line back end and journaling software they put you in the position to succeed.

I HAVE PAUSED ALL STREAMING STILL UNTIL FURTHER NOTICE! I WILL BE BACK IN DUE TIME BUT I NEED TO REFOCUS IN ON THE PROCESS AND THIS IS PHASE 1!!! SEE YOU SOON IN THE MEANTIME PLAN YOUR TRADE, TRADE YOUR PLAN! DON’T DO DUMB $HIT!!!!

As always if you have any questions or comments about this writeup, my trading, the coffee or just want to say hi, please fill out the form below and leave some comments! Everything I share here is for your benefit, if you would like me to add any information or analyze some other charts please let me know as I will only add something if I am trading it otherwise.

Disclaimer: Trading and Investing is a highly personal venture and nothing I say here is advice for your specific situation. As always, consult a financial advisor or professional and be sure to do your own due diligence.