Weekly Analysis 8/11/2024

What a week of volatility we just experienced! As soon as I finished writing up this post last week the markets decided it was time to go for a ride. Let’s jump into the breakdown. The chart below may seem clean, but it was anything but that. We opened with that big gap down and the selling was on, mainly due to the Yen carry trade paired with some sentiment here on the rate decision front. I spoke about the 18544 level on Friday before I got off stream and said any rejection would likely take us down to the 18277 level. That gap down and open placed us right at that point of interest and the flush through there took out each key level lower into almost the 7% halt down price. Lucky for markets the 17478.75 zone was strong enough to hold us up into Monday. The rotation back to the gap was on and we took aim at it each day into Wednesday and finally breached the high briefly before rolling back down to the bottom of the bearish channel we formed from CPI highs. With no new news or data points telling us to push lower and the levels around 17829 holding we rotated back to close the week in the green. So in reality, extreme fear stepping in early only to be bought right back up from nearly 7% down do up over the previous week close. Markets cleaned up the lows, rotated back and took care of the gap, now we can look ahead to see if a healthy price action remains for the week ahead.

Note that the 18,544 level and the amount of reaction that comes along with it.

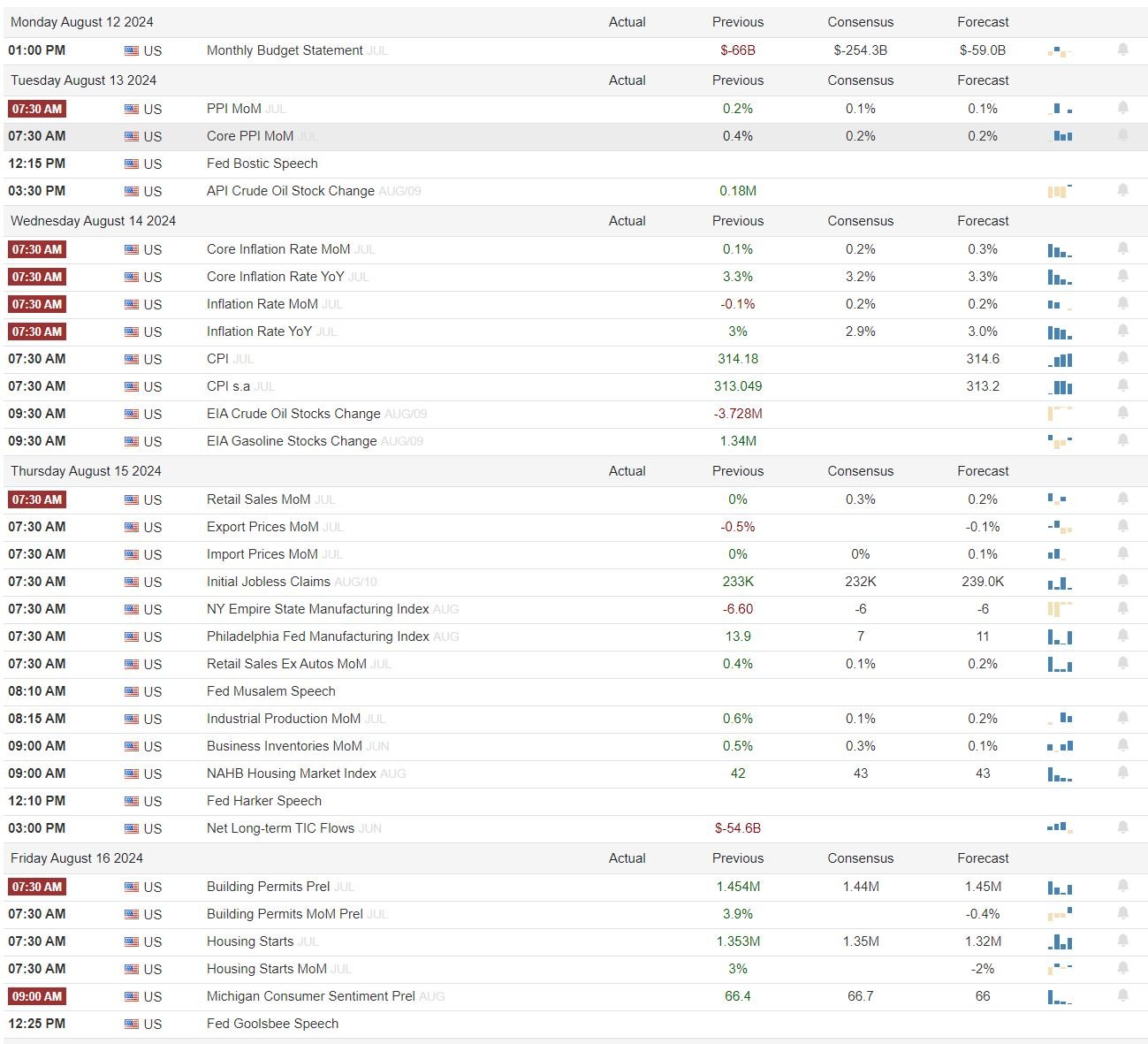

Looking ahead we start with our important data releases for the week:

All eyes will be on the Wednesday CPI. Inflation is the main event that everyone will be monitoring as the FED will be using this as a factor for cutting rates sooner rather than later. With a lack of data leading into Wednesday, I would expect a cool down in volatility early in the week and then more movement once that comes out.

Earnings for the week:

Headlines moving Markets:

Global unrest with multiple wars being wages and ramping up could lead to some flights to safe haven assets. Last week showed panic could come in fast and many investors may seek a way to avoid that downside. Also look for weapons companies to continue to prosper.

After last week the Extreme Fear is going to take some time to shake out. This could open the week with some upside pressure, if the confidence sets back in and CPI comes out better than anticipated then watch this swing the other way, and fast. Just like last week, I stated that this fear level brings out the big bulls, and they stepped up early once that major sellside came in and did not give up as we progressed through the week.

A request came across the tape via the form at the bottom of the page for a Gold breakdown. As promised, if requested, I will do my best on charting. Without further ado here is my /GC futures analysis:

As we can see from the chart below we have held the Gap up from the contract roll at the end of July. This gap up has been retested and has acted now as support. The major selling in the equities should have led to a flee to safety and into things such as gold. What we ended up seeing was an equal selling pressure in the gold market, this was panic sellers liquidating everything and into Monday it could have led to that gap filling, which we can see it did not. A major area of interest that I would be mindful of is that 2421.6 level. Buyers stepped up there 5 times and when the price returns here it will be interesting to see if they step up again, if not the gap fill will be the next zone downside. On the upside we are holding the 2456 support level for now and anything over this level should lead to a consistent bid back up. I feel that with much of the uncertainty in markets as of now we could see the safer assets start to perform better. Levels above will be the 2474.20, 2487.9, and 2522.5. Like I mentioned a bullish pressure could keep us going up along with the fear in the markets. CPI data will either pump us up if its worse than expected or shoot for that gap fill if the rate cut is all but decided off that number. Its all wait and see but as of now we are having some good levels to work with.

HERE ARE MY NQ LEVELS TO WATCH FOR THE WEEK:

With the price action from last week all but washed out we are back at the point we were at close 2 Friday’s ago. So with that being said all of the levels from last week still apply for this week. 18,544 will be my bullish/bearish line in the sand once again and will watch as price will attempt to break back to the upside over the upper end of the bearish channel we had formed (blue line below). Overhead if the bulls keep control that 18,700 is the next important level, followed by 18,900 then 19,000. To the downside we will watch that 18,400. If that fails to hold the levels from last week will be key all the way back down to the 17829 area. Overall I anticipate it to be less wild than last week but still slightly increased. Wednesday will be the big spark and could give lots of opportunity to catch a runner. Lets observe and react and as always DDD$!

Streaming Schedule for the Week Ahead:

30 DAY BOOTCAMP IS HERE.

THERE ARE LAST MINUTE SEATS STILL AVAILABLE!

HIT MY LINK AND USE CODE POLICINGPIPS FOR 10% OFF

Monday 0830-1100 CST

Tuesday 0830-0930 CST

Wednesday 0830-1100 CST

Thursday 0830-1100 CST

Friday: 0830-1100 CST

Stream can be found here TRADECASTER

and on YOUTUBE

As always if you have any questions or comments about this writeup, my trading, the coffee or just want to say hi, please fill out the form below and leave some comments! Everything I share here is for your benefit, if you would like me to add any information or analyze some other charts please let me know as I will only add something if I am trading it otherwise.